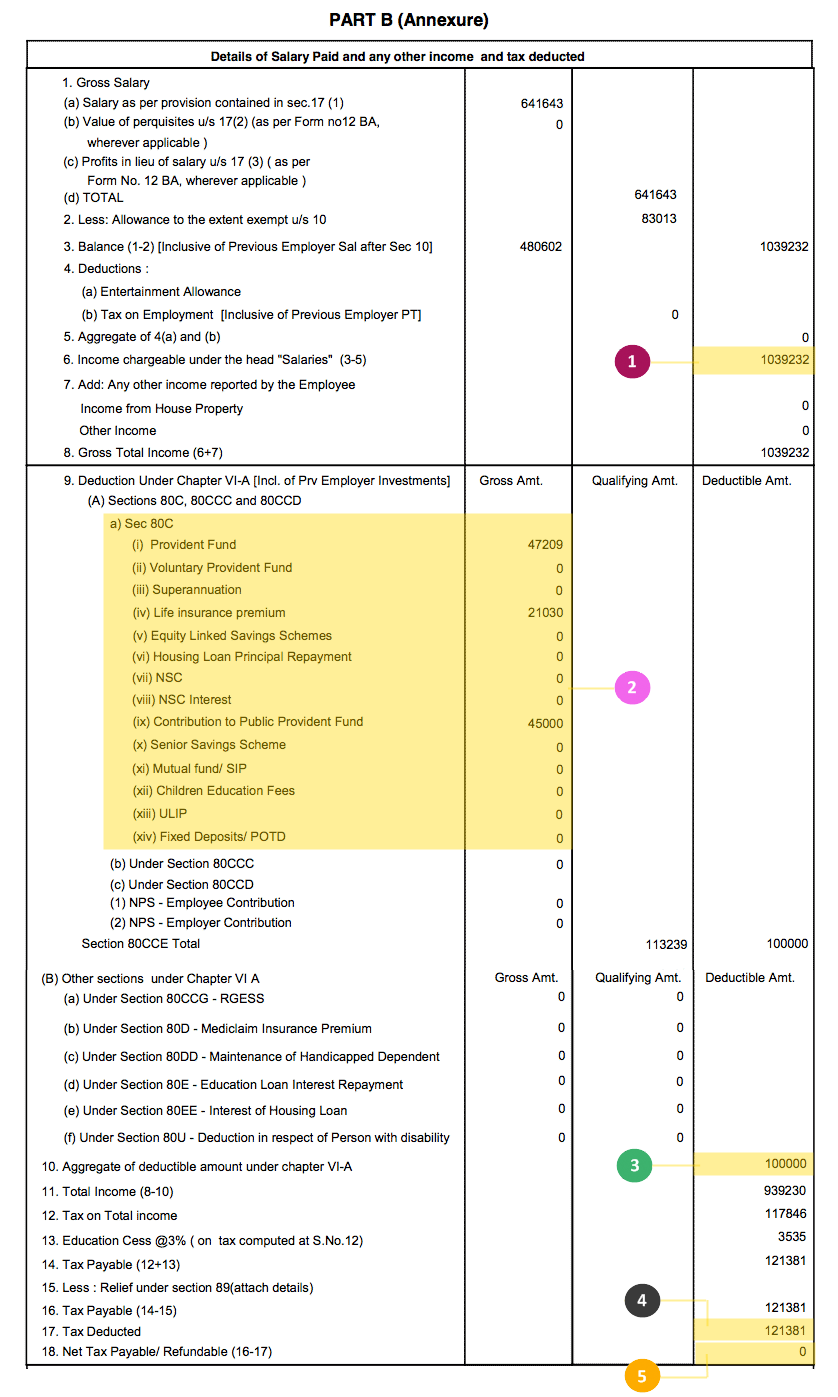

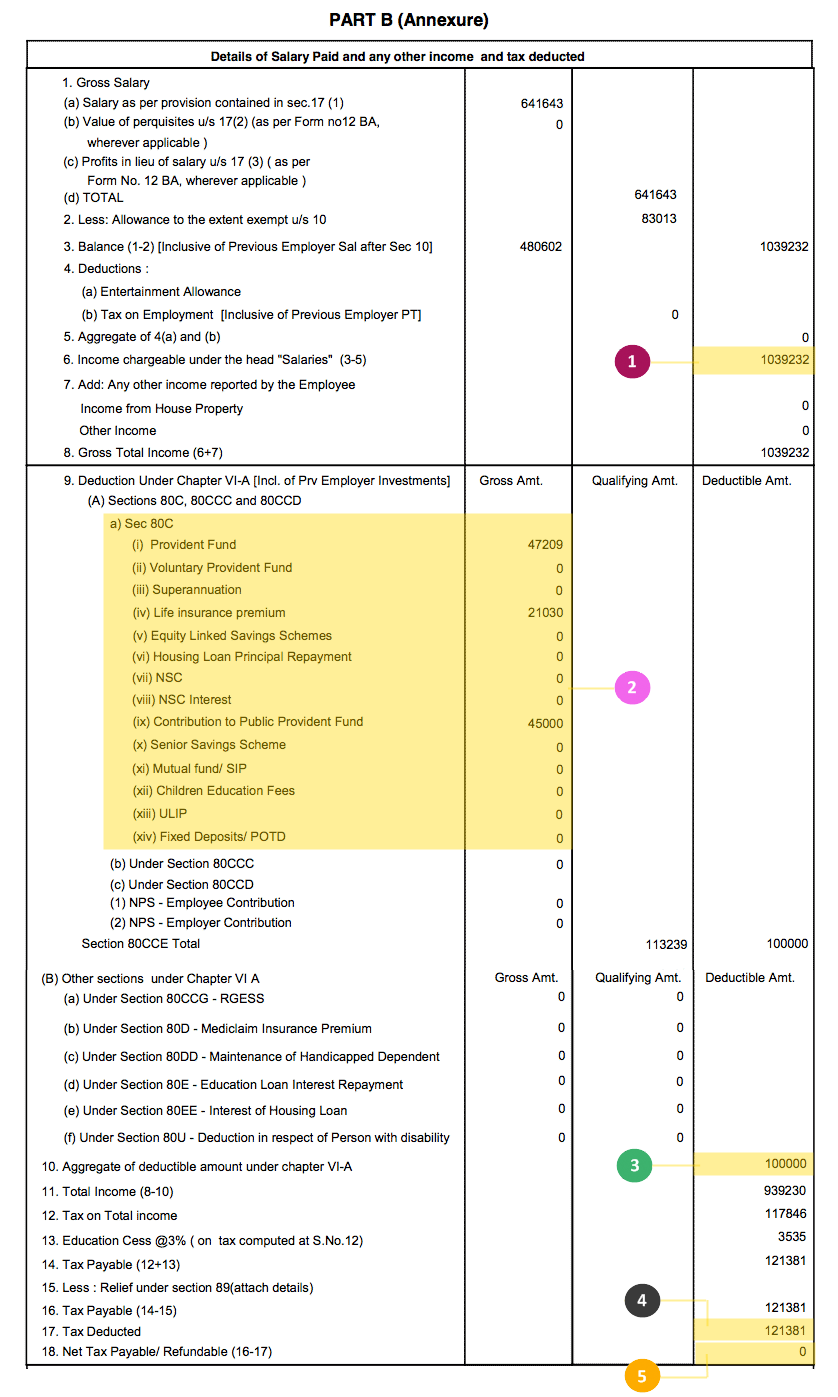

A new section 80C was introduced (replacing section 88) from the financial year 2005-06. Under this Section, a deduction of upto Rs.1,50,000/- (wef FY 2014-15) is allowed from Taxable Income in respect of the investments made in some specified schemes. The schemes are similar as were available in Section 88 earlier. Now there are no sectoral caps and individuals can save in any of the schemes upto Rs.1,50,000/- (now even in PPF it is allowed upto Rs. 1.50 lac as against only Rs.1 lakh upto March 2014).. The tax payers can plan their investments / savings so as to achieve their financial goals. The details of such schemes along with some major features of each of these are given below : -

1. NSC(NATIONAL SAVING CERTIFICATES) IN POST OFFICES

2. PPF IN POST OFFICES OR BANKS (UPTO 1.5 LACS) INTEREST IS TAX FREE

3. EPF (EMPLOYEE PROVIDENT FUND) UPTO 1.5 LACS INT IS TAX FREE

3. TAX SAVING FDs IN BANKS OR 5 YEAR TERM DEPOSIT IN POST OFFICES

4. NATIONAL PENSION SYSTEM 80 C-150000 AND 80 CCD ABOVE 1.5 LACS- 50000

5. SUKANYA SAMRUDHI YOJANA IN POST OFFICES OR BANKS (INT IS TAX FREE)

6. SCSS(SENIOR CITIZEN SAVING SCHEME) UPTO 1.5 LACS

7. UNIT LINKED INSURANCE POLICES AND POSTAL LIFE INSURANCE, RURAL POST LIFE INSURANCE, SOME OF POLICES OF PRIVATE SECTOR AND PUBLIC SECTOR INSURANCE COMPANIES

8. CHILDREN'S TUITION FEES

9. REPAYMENT OF HOME LOAN

These are the benefits you are getting under 80-c beyond to this you will also get benefit under

Section 80CCC: Deduction for Premium Paid for Annuity Plan of LIC or Other Insurer

This section provides deduction to an Individual for any amount paid or deposited in any annuity plan of LIC or any other insurer. The plan must be for receiving pension from a fund referred to in Section 10(23AAB).

If the annuity is surrendered before the date of its maturity, the surrender value is taxable in the year of receipt.

Section 80CCD: Deduction for Contribution to Pension Account

Employee's contribution – Section 80CCD(1) Allowed to an Individual who makes deposits to his/her Pension account. Maximum deduction allowed is 10% of salary (in case of taxpayer being an employee) or 10% of gross total income (in case of tax payer being self-employed) or Rs 1,00,000 whichever is less. The limit of Rs 1,00,000 has been increased to Rs 1,50,000 starting financial year 2015-16 (assessment year 2016-17).

Deduction for self contribution to NPS - section 80CCD(1B) A new section 80CCD(1B) has been introduced for additional deduction for amount deposited by a taxpayer to their NPS account . Contributions to Atal Pension Yojana are also eligible. Deduction is allowed on contribution up to Rs 50,000.

Employer's contribution – Section 80CCD(2) Deduction is allowed for employer's contribution to employee’s pension account up to 10% of the salary of the employee. There is no monetary ceiling on this deduction.

Deductions on Interest on Savings Account

Section 80 TTA: Deduction from gross total income for Interest on Savings bank account

A deduction of maximum Rs 10,000 can be claimed against interest income from a savings bank account. Interest from savings bank account should be first included in other income and deduction can be claimed of the total interest earned or Rs 10,000, whichever is less. This deduction is allowed to an individual or HUF. And it can be claimed for interest on deposits in savings account with a bank, co-operative society or post office. Section 80TTA deduction is not available on interest income from fixed deposits or recurring deposits or interest income from corporate bonds.

Deductions on House Rent

Section 80GG: Deduction for House Rent Paid where HRA is not received

- This deduction is available for rent paid when HRA is not received. Taxpayer or his spouse or minor child should not own residential accommodation at the place of employment.

- Taxpayer should not have self-occupied residential property in any other place.

- Taxpayer must be living on rent and paying rent.

Deduction available is the minimum of

- Rent paid minus 10% of total income

- Rs. 2000/- per month

- 25% of total income

For Financial year 2016-17 – For calculating deduction above, Rs 2,000 per month has been raised to Rs 5,000 per month. Therefore a maximum of Rs 60,000 per annum can be claimed as a deduction.

Deductions on Education Loan for Higher Studies

Section 80E: Deduction for Interest on Education Loan for Higher Studies

Deduction is allowed for interest on loan taken for pursuing higher education. This loan may have been taken for the taxpayer, spouse or children or for a student for whom the taxpayer is a legal guardian. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier. There is no restriction on the amount that can be claimed.

Deduction for First Time Home Owners

Section 80EE: Deductions on Home Loan Interest for First Time Home Owners

For Financial Year 2013-14 and Financial Year 2014-15

This section provided deduction on the Home Loan Interest paid. The deduction under this section is available only to Individuals for first house purchased where the value of the house is Rs 40lakhs or less and loan taken for the house is Rs 25lakhs or less. And the Loan has been sanctioned between 01.04.2013 to 31.03.2014. The aggregate deduction allowed under this section cannot exceed Rs 1,00,000 and is allowed for financial years 2013-14 & 2014-15 (Assessment year 2014-15 and 2015-16).

This deduction is not available for financial year 2015-16 (assessment year 2016-17).

For Financial Year 2016-17

This section was revived in Budget 2016 and is applicable starting FY 2016-17. The deduction under this section is available only to an Individual who is a first time home owner. The value of the property purchased must be less than Rs 50 Lakhs and home loan must be less than Rs 35 lakhs. And the Loan must be taken from a financial institution and must be sanctioned between 01.04.2016 to 31.03.2017. Under this section, an additional deduction of Rs 50,000 can be claimed on home loan interest. This is in addition to deduction of Rs 2,00,000 allowed under section 24 of the income tax act for a self-occupied house property. There is no restriction on the number of years for which this deduction can be claimed.

Deductions on Rajiv Gandhi Equity Saving Scheme (RGESS)

Section 80CCG: Rajiv Gandhi Equity Saving Scheme (RGESS)

The Rajiv Gandhi Equity Saving Scheme (RGESS) was launched after the 2012 Budget. Investors whose gross total income is less than Rs. 12 lakhs can invest in this scheme. Upon fulfilment of conditions laid down in the section, the deduction is lower of, 50% of amount invested in equity shares or Rs 25,000.

Deductions on Medical Insurance

Section 80D: Deduction for premium paid for Medical Insurance

For financial year 2014-15 - Deduction is available up to Rs. 15,000/- to a taxpayer for insurance of self, spouse and dependent children. If individual or spouse is more than 60 years old the deduction available is Rs 20,000. An additional deduction for insurance of parents (father or mother or both) is available to the extent of Rs. 15,000/- if less than 60 years old and Rs 20,000 if parents are more than 60 years old. Therefore, the maximum deduction available under this section is to the extent of Rs. 40,000/-. (From AY 2013-14, within the existing limit a deduction of up to Rs. 5,000 for preventive health check-up is available).

For financial year 2015-16– Deduction is raised from Rs 15,000 to Rs 25,000. The deduction for senior citizens is raised from Rs 20,000 to Rs 30,000. For uninsured super senior citizens (more than 80 years old) medical expenditure incurred up to Rs 30,000 shall be allowed as a deduction under section 80D. However, total deduction for health insurance premium and medical expenses for parents shall be limited to Rs 30,000.

Deductions on Medical Expenditure for a Handicapped Relative

Section 80DD: Deduction for Rehabilitation of Handicapped Dependent Relative

Deduction is available on:

- Expenditure incurred on medical treatment, (including nursing), training and rehabilitation of handicapped dependent relative

- Payment or deposit to specified scheme for maintenance of dependent handicapped relative.

Where disability is 40% or more but less than 80% - fixed deduction of Rs 50,000.

Where there is severe disability (disability is 80% or more) – fixed deduction of Rs 1,00,000.A certificate of disability is required from prescribed medical authority.

Note: A person with 'severe disability' means a person with 80% or more of one or more disabilities as outlined in section 56(4) of the 'Persons with disabilities (Equal opportunities, protection of rights and full participation)' Act.

- Certificate can be taken from a Specialist as specified.

- Patients getting treated in a private hospital are not required to take the certificate from a government hospital.

- Patients receiving treatment in a government hospital have to take certificate from any specialist working full-time in that hospital. Such specialist must have a post-graduate degree in General or Internal Medicine or any equivalent degree, which is recognised by the Medical Council of India.

- Certificate in Form 10I is no longer required. The certificate must have - name and age of the patient, name of the disease or ailment, name, address, registration number and the qualification of the specialist issuing the prescription. If the patient is receiving the treatment in a Government hospital, it should also have name and address of the Government hospital.

For financial year 2015-16 – The deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Deductions on Medical Expenditure on Self or Dependent Relative

Section 80DDB: Deduction for Medical Expenditure on Self or Dependent Relative

A deduction Rs. 40,000/- or the amount actually paid, whichever is less is available for expenditure actually incurred by resident taxpayer on himself or dependent relative for medical treatment of specified disease or ailment.

The diseases have been specified in Rule 11DD. A certificate in form 10 I is to be furnished by the taxpayer from any Registered Doctor.

In case of senior citizen the deduction can be claimed up to Rs 60,000 or amount actually paid, whichever is less.

For financial year 2015-16 – for very senior citizens Rs 80,000 is the maximum deduction that can be claimed.

Deductions for Person suffering from Physical Disability

Section 80U: Deduction for Person suffering from Physical Disability

Deduction of Rs. 50,000/- to an individual who suffers from a physical disability (including blindness) or mental retardation. In case of severe disability, deduction of Rs. 100,000 can be claimed. Certificate should be obtained from a Govt. Doctor. The relevant rule is Rule 11D. This is a fixed deduction and not based on bills or expenses.

For financial year 2015-16 – The deduction limit of Rs 50,000 has been raised to Rs 75,000 and Rs 1,00,000 has been raised to Rs 1,25,000.

Deduction for donations towards Social Causes

Section 80G: Deduction for donations towards Social Causes

The various donations specified in Sec. 80G are eligible for deduction up to either 100% or 50% with or without restriction as provided in Sec. 80G. 80G deduction not applicable in case donation is done in form of cash for amount over Rs 10,000.

Donations with 100% deduction without any qualifying limit:

- National Defence Fund set up by the Central Government

- Prime Minister's National Relief Fund

- National Foundation for Communal Harmony

- An approved university/educational institution of National eminence

- Zila Saksharta Samiti constituted in any district under the chairmanship of the Collector of that district

- Fund set up by a State Government for the medical relief to the poor

- National Illness Assistance Fund

- National Blood Transfusion Council or to any State Blood Transfusion Council

- National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities

- National Sports Fund

- National Cultural Fund

- Fund for Technology Development and Application

- National Children's Fund

- Chief Minister's Relief Fund or Lieutenant Governor's Relief Fund with respect to any State or Union Territory

- The Army Central Welfare Fund or the Indian Naval Benevolent Fund or the Air Force Central Welfare Fund, Andhra Pradesh Chief Minister's Cyclone Relief Fund, 1996

- The Maharashtra Chief Minister's Relief Fund during October 1, 1993 and October 6,1993

- Chief Minister's Earthquake Relief Fund, Maharashtra

- Any fund set up by the State Government of Gujarat exclusively for providing relief to the victims of earthquake in Gujarat

- Any trust, institution or fund to which Section 80G(5C) applies for providing relief to the victims of earthquake in Gujarat (contribution made during January 26, 2001 and September 30, 2001) or

- Prime Minister's Armenia Earthquake Relief Fund

- Africa (Public Contributions — India) Fund

- Swachh Bharat Kosh (applicable from financial year 2014-15)

- Clean Ganga Fund (applicable from financial year 2014-15)

- National Fund for Control of Drug Abuse (applicable from financial year 2015-16)

Donations with 50% deduction without any qualifying limit.

- Jawaharlal Nehru Memorial Fund

- Prime Minister's Drought Relief Fund

- Indira Gandhi Memorial Trust

- The Rajiv Gandhi Foundation

Donations to the following are eligible for 100% deduction subject to 10% of adjusted gross total income

- Government or any approved local authority, institution or association to be utilised for the purpose of promoting family planning

- Donation by a Company to the Indian Olympic Association or to any other notified association or institution established in India for the development of infrastructure for sports and games in India or the sponsorship of sports and games in India.

Donations to the following are eligible for 50% deduction subject to 10% of adjusted gross total income

- Any other fund or any institution which satisfies conditions mentioned in Section 80G(5)

- Government or any local authority to be utilised for any charitable purpose other than the purpose of promoting family planning

- Any authority constituted in India for the purpose of dealing with and satisfying the need for housing accommodation or for the purpose of planning, development or improvement of cities, towns, villages or both

- Any corporation referred in Section 10(26BB) for promoting interest of minority community

- For repairs or renovation of any notified temple, mosque, gurudwara, church or other place.

Deductions on Contribution by Companies to Political Parties

Section 80GGB: Deduction on contributions given by companies to Political Parties

Deduction is allowed to an Indian company for amount contributed by it to any political party or an electoral trust. Deduction is allowed for contribution done by any way other than cash.

Political party means any political party registered under section 29A of the Representation of the People Act. Contribution is defined as per section 293A of the Companies Act, 1956.

Deductions on Contribution by Individuals to Political Parties

Section 80GGC: Deduction on contributions given by any person to Political Parties

Deduction is allowed to a taxpayer for any amount contributed to any political party or an electoral trust. Deduction is allowed for contribution done by any way other than cash.

Political party means any political party registered under section 29A of the Representation of the People Act.

Deductions on Income by way of Royalty of a Patent

Section 80RRB: Deduction with respect to any Income by way of Royalty of a Patent

Deduction for any income by way of royalty for a patent registered on or after 01.04.2003 under the Patents Act 1970 shall be available up to Rs. 3 lakhs or the income received, whichever is less. The taxpayer must be an individual resident of India who is a patentee. The taxpayer must furnish a certificate in the prescribed form duly signed by the prescribed authority.